-

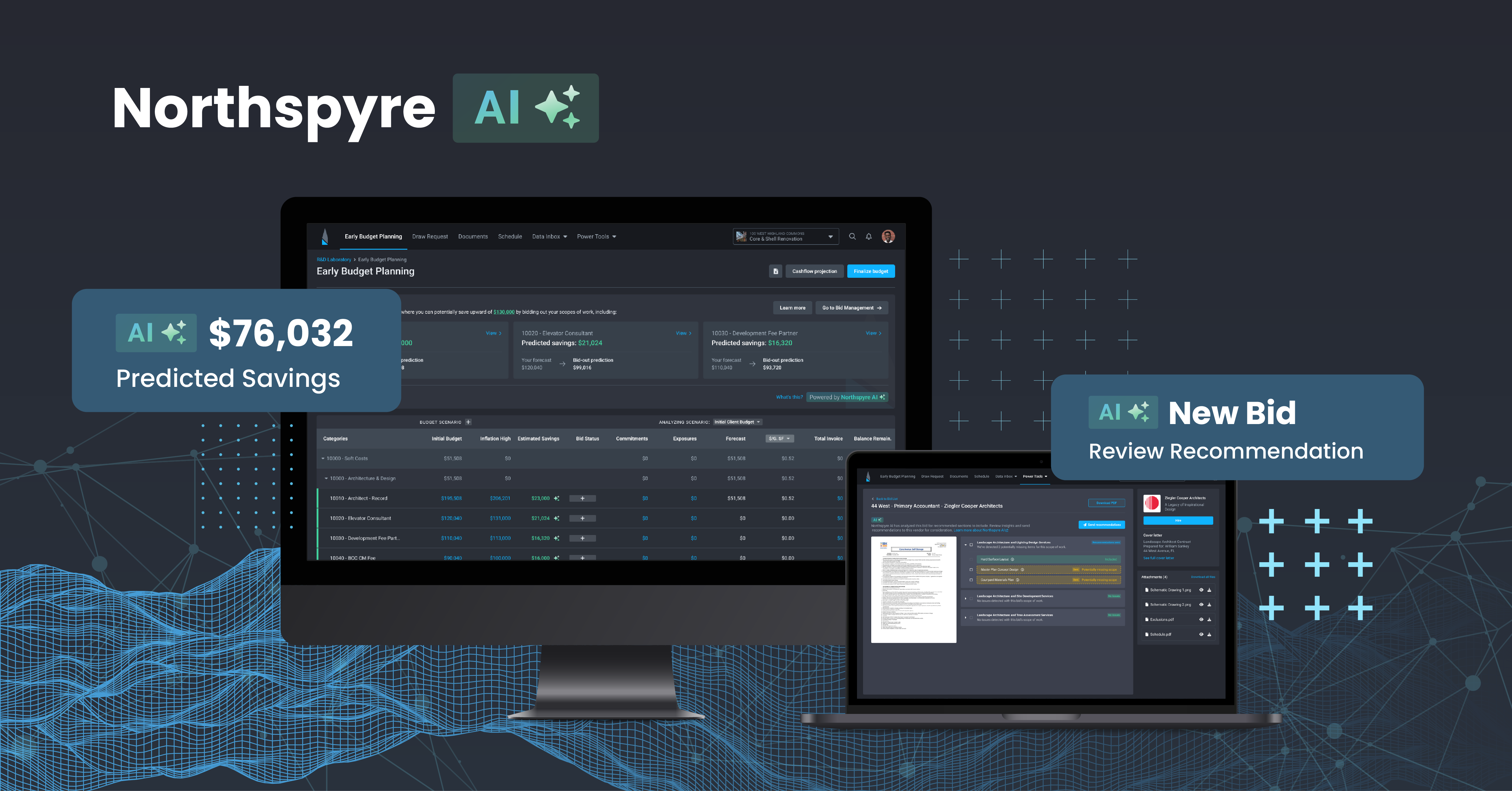

Revolutionizing Real Estate Development: Introducing Northspyre AI & More

Sophisticated developers understand that half the battle in ensuring a project’s success happens before construction begins. In the pre-development stage, crucial decisions are made: Are you working with the right vendors? Are your vendor bids and contracts airtight to minimize future change orders? Simply put, are you setting yourself up for success? Or are you

-

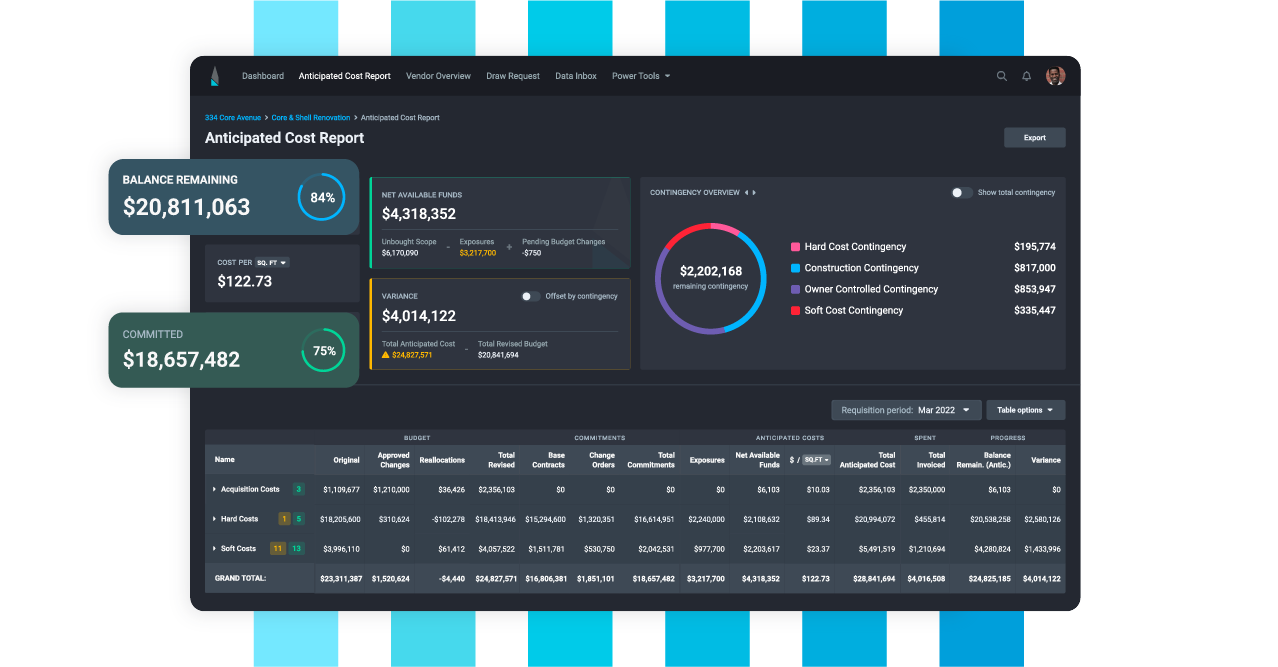

How Real Estate Development Software Unites Finance and Project Teams

Over the course of a complex development process, your project management and financial teams need to communicate to bring projects in on time and under budget. Finance and project teams work together to ensure a project is financially feasible, capital is deployed correctly, and investors or other key stakeholders receive reports on a project’s progress.

-

5 Tips for Vetting Real Estate Software Development Company Options

The commercial real estate industry has undeniably embraced technology. Nearly 100% of commercial real estate companies have invested in technology and are expanding technology programs—and technology advancement continues to rank at the top of trends driving the industry forward. As in daily life, tech-powered tools are quickly becoming a standard part of real estate operations,

-

The Proptech Industry Embraces Diversification in 2024

It’s been a rocky year for investors across all sectors. In 2023, commercial real estate investment experienced its fair share of dislocation, and CRE investment is down as much as 60% this year. But real estate isn’t the only space where investors have become skittish. Venture capital investors have also dramatically reduced funding for innovation

-

How to Leverage Automation Across the Real Estate Development Process

When many Americans get home at the end of the day, they unlock their front door with a cell phone and turn on the house lights with their voice. Air conditioners switch on instantly, home assistants play music and the ovens begin heating up for dinner, all without touching a button. It’s all made possible

-

The Next Leap with Northspyre 2.0: Elevating Real Estate Development

Real estate development is a complex industry, requiring you to navigate a variety of factors, from shifting market conditions to zoning and regulatory standards to stakeholder involvement. Delivering projects on time and under budget is more difficult than ever amid modern development challenges like ongoing economic uncertainty, labor shortages, and supply chain disruptions. Northspyre’s

-

A Real Estate Developer’s Guide to Software

Over the last few years, the COVID-19 pandemic, macroeconomic conditions, and changing expectations around work and lifestyle have increased the need for technology across industries. In a McKinsey survey of 800 executives, 85% of respondents said their businesses had accelerated digitization. Though the real estate industry has been slower to adopt new technology in comparison

-

The Potential of ChatGPT in Real Estate: A Developer’s Dream Come True

How ChatGPT is shaping the real estate industry and helping developers.

-

Data Opens Big Doors for Small Real Estate Developers

Three ways data & analytics are transforming small development shops for the better.