Northspyre Blog

Expert insights & resources

Stay informed with the latest tech trends, industry insights, and best practices for real estate development.

Market Trends, Real Estate Development

The Future of CRE Development Acquisitions: 2026 Digital Trends to Watch

Discover the top trends to watch in CRE development acquisitions.

Real Estate Development, Technology

How to Develop a Strategy-Focused Development Pro Forma for Smarter Real Estate Projects

Learn the ins an outs of development pro forma, with the strategy driven…

Real Estate Development, Real Estate Technology

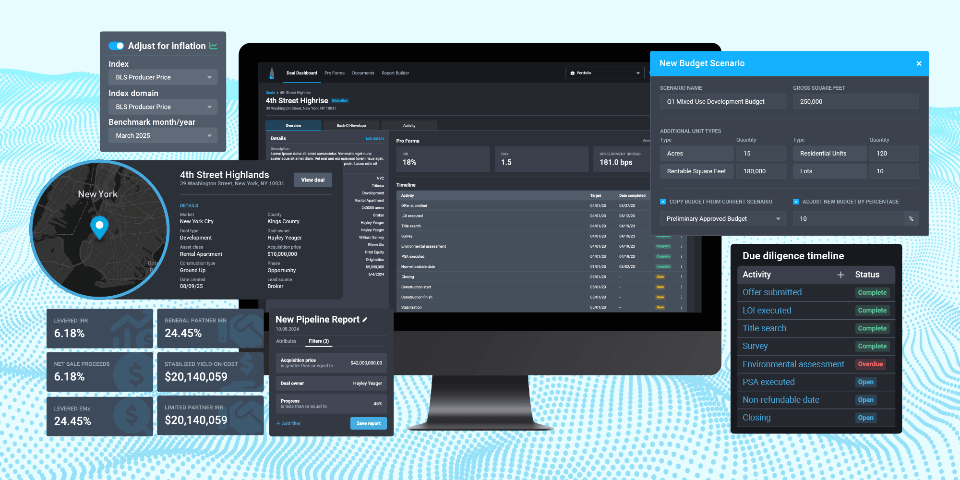

Supercharge Acquisitions & Investment: Introducing Northspyre Deal

Discover how Northspyre Deal keeps teams aligned and accountable across the development pipeline.

Real Estate Development, Real Estate Technology

Mastering the DCF Model for Real Estate: How to Leverage Tech for Better Financial Forecasting

Here's how to master the DCF model for real estate.

Real Estate Development, Technology

Smarter, Faster, More Predictable: How Northspyre Powered Real Estate Development in 2025

A look back at product updates, new features, and achievements in 2025.

Market Trends, Real Estate Development

Why Manufacturing is Taking the Spotlight in Industrial Development

Learn how legislation is boosting manufacturing in industrial development.

Market Trends, Real Estate Development

2026 Trends to Watch in Commercial Real Estate

Here are the top 2026 trends in CRE to watch.

Market Trends, Real Estate Development

3 Ways to Defer Capital Gains on Your Commercial Real Estate Sale

No one likes a tax bill, but in the commercial real estate industry,…

Market Trends, Real Estate Development

2026 PropTech Trend Predictions

Top 5 poptech trends that will impact real estate development in 2026.

See Northspyre in action

See how leading developers use Northspyre to work smarter at every stage of the development lifecycle.