Unlock your competitive advantage

In an increasingly competitive real estate industry, challenged by shrinking margins, market volatility, and frequent staff turnover, actionable real estate analytics software is the key to amplifying your firm’s success. However, siloed, incomplete, and rigid data often stands in the way.Northspyre’s powerful, built-in analytics turns the mountain of cost and vendor data across your portfolio into actionable insights, seamlessly embedding them into the flow of work to deliver data-driven guidance at critical decision points in the project lifecycle. Instead of repeating mistakes, your team learns from past projects and becomes smarter with every investment analysis and portfolio decision.

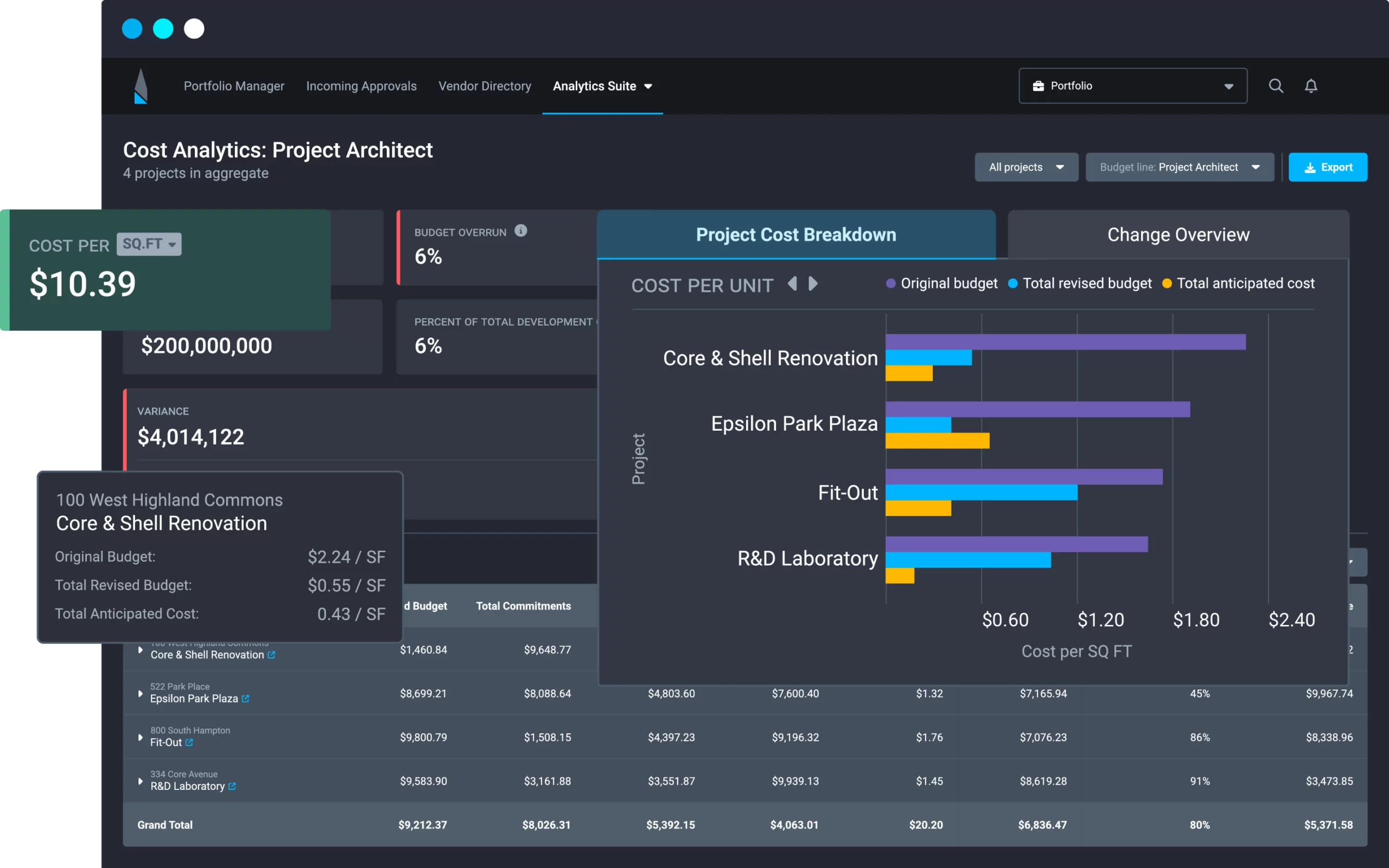

Benchmark Costs Across Projects

Compare performance and reduce cost overruns.

Evaluate Vendor ROI

Find top vendors using real-time performance data.

Visualize Portfolio Spend

Track budget forecasts across your full portfolio.

Plan Capital with Confidence

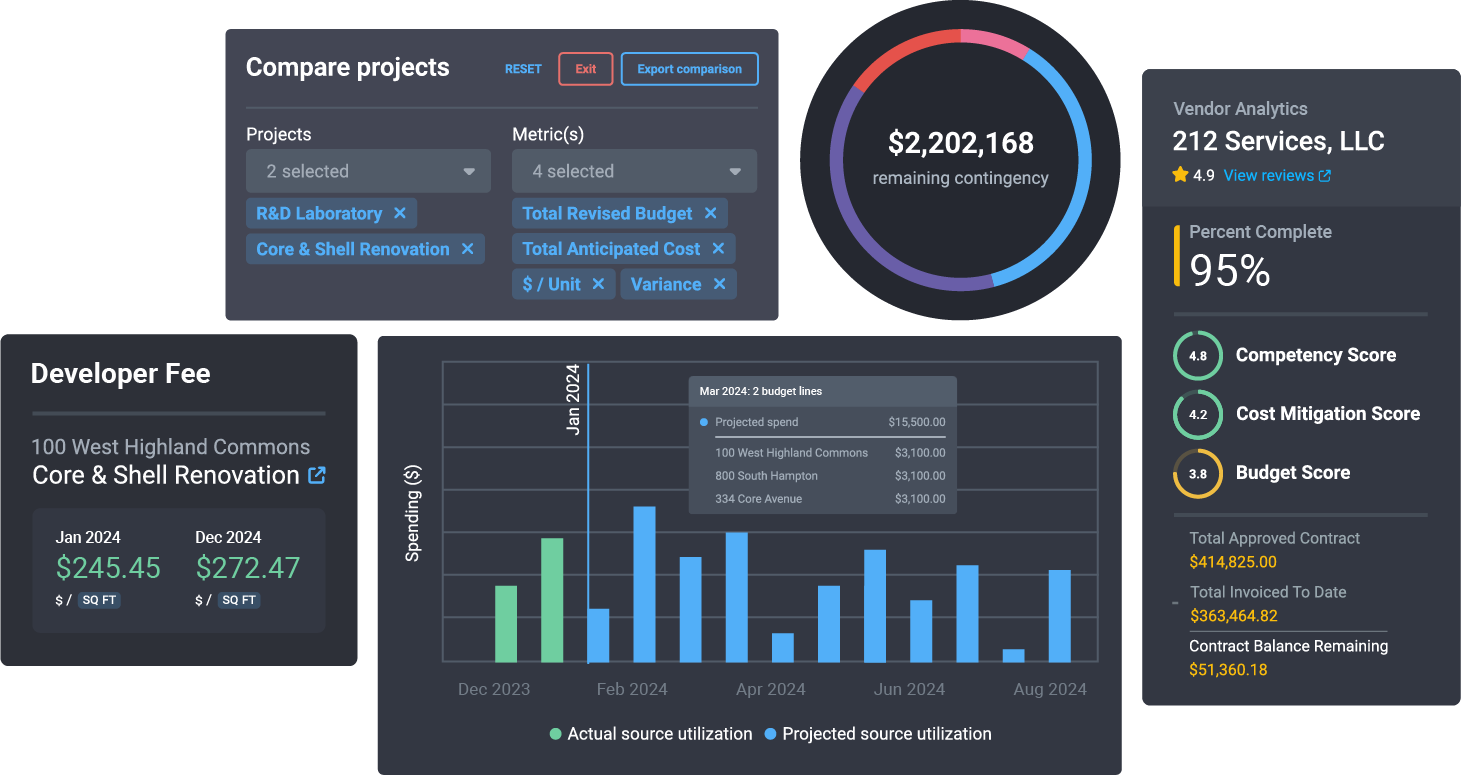

Forecast cash flow and funding across all projects.

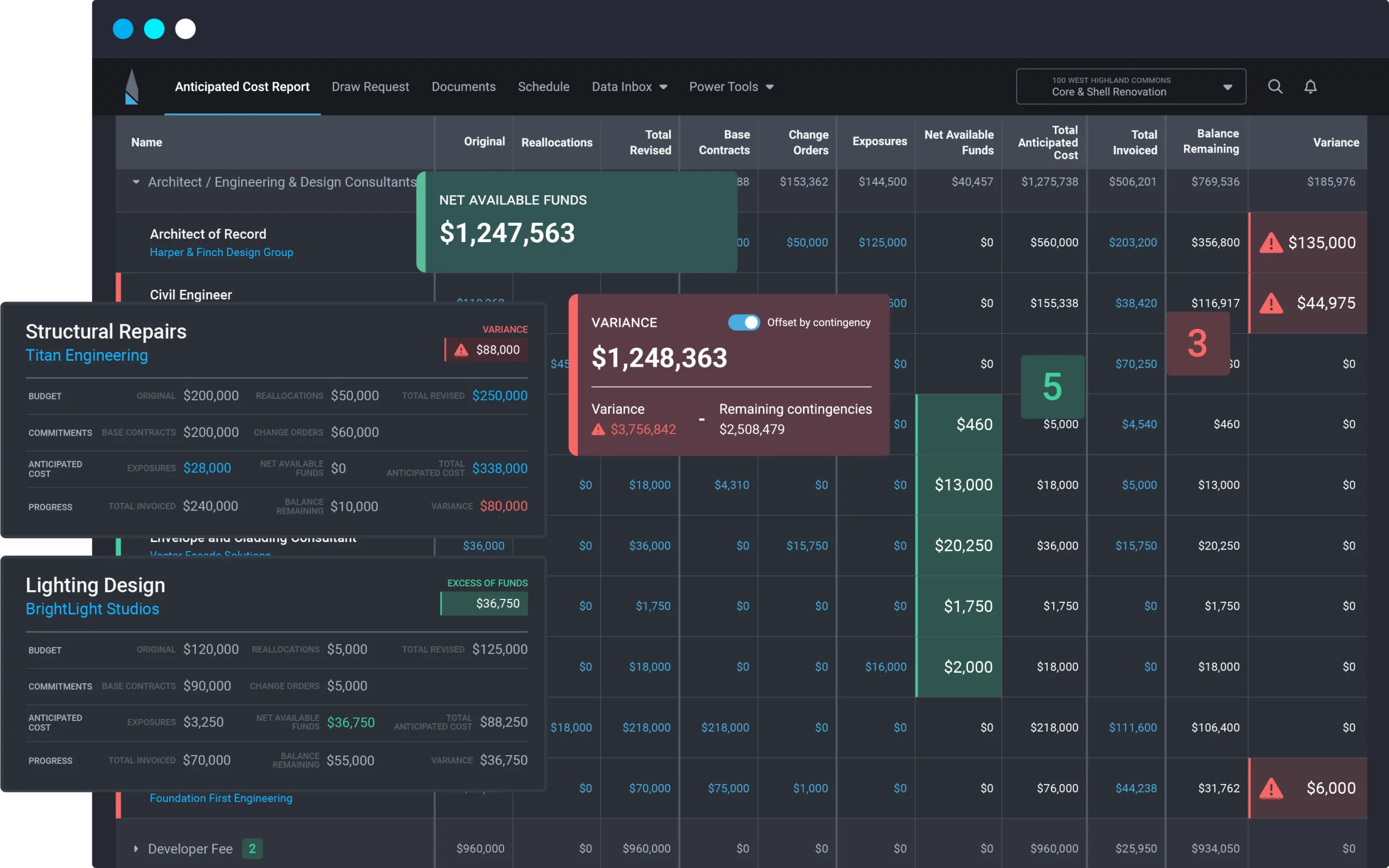

Cost Analytics

Turn cost data into actionable insights

Set cost benchmarks across your portfolio to evaluate project performance in real time and inform future budgets. Track overages and the causes of change orders to pinpoint missteps and improve returns. For deeper analysis, create project groups and focus on the budget lines and metrics you care about most.

VENDOR ANALYTICS

Identify high ROI vendors—and those that are costing you

Surface vendor performance trends across your portfolio to evaluate who consistently bids low, who submits frequent change orders, and who delivers reliably. With these insights, procurement teams can minimize active risk and select partners who consistently perform well.

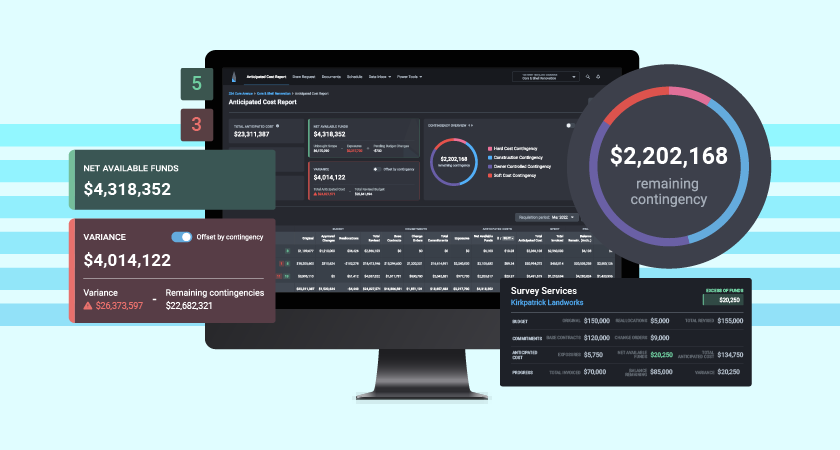

GLOBAL COST FORECAST

Forecast and Compare Portfolio Costs

Quickly pinpoint available funds or detect overruns with a unified view of anticipated costs across your portfolio. Drill into specific metrics to uncover discrepancies and identify drivers behind higher or lower costs. Compare projects to similar ones or to benchmarks to track performance across categories. Use these insights to make informed adjustments that enhance profitability and resource performance.

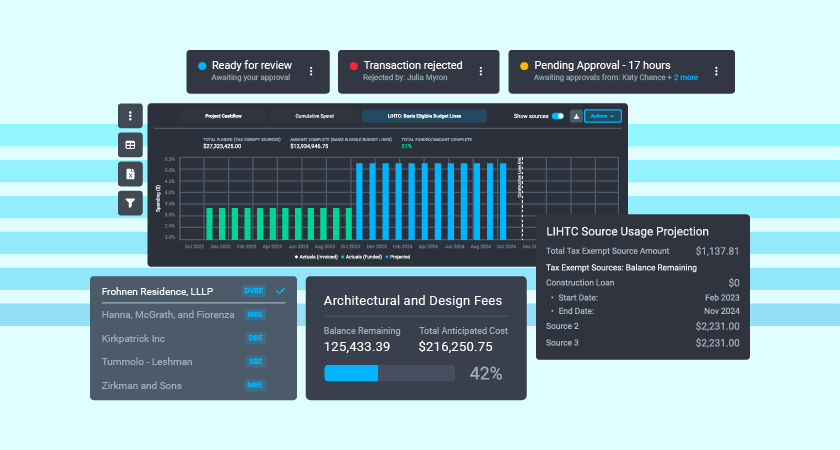

PORTFOLIO CAPITAL PLANNING

Engage in smarter capital planning

Improve forecast accuracy with a comprehensive, portfolio-level view of source utilization and multi-year cash flow projections. Inform fundraising over a 3–5 year period, provide partners with early visibility into equity needs, and allocate resources strategically—all while staying agile to adapt to market shifts or evolving priorities.

Developer Fee

Monitor developer fees

Aggregate developer fee cash flow across your projects to get a holistic view of projected income, making it easier to manage and understand your operating costs around the clock.

Fuel decision-making and business intelligence with

purpose-built analytics

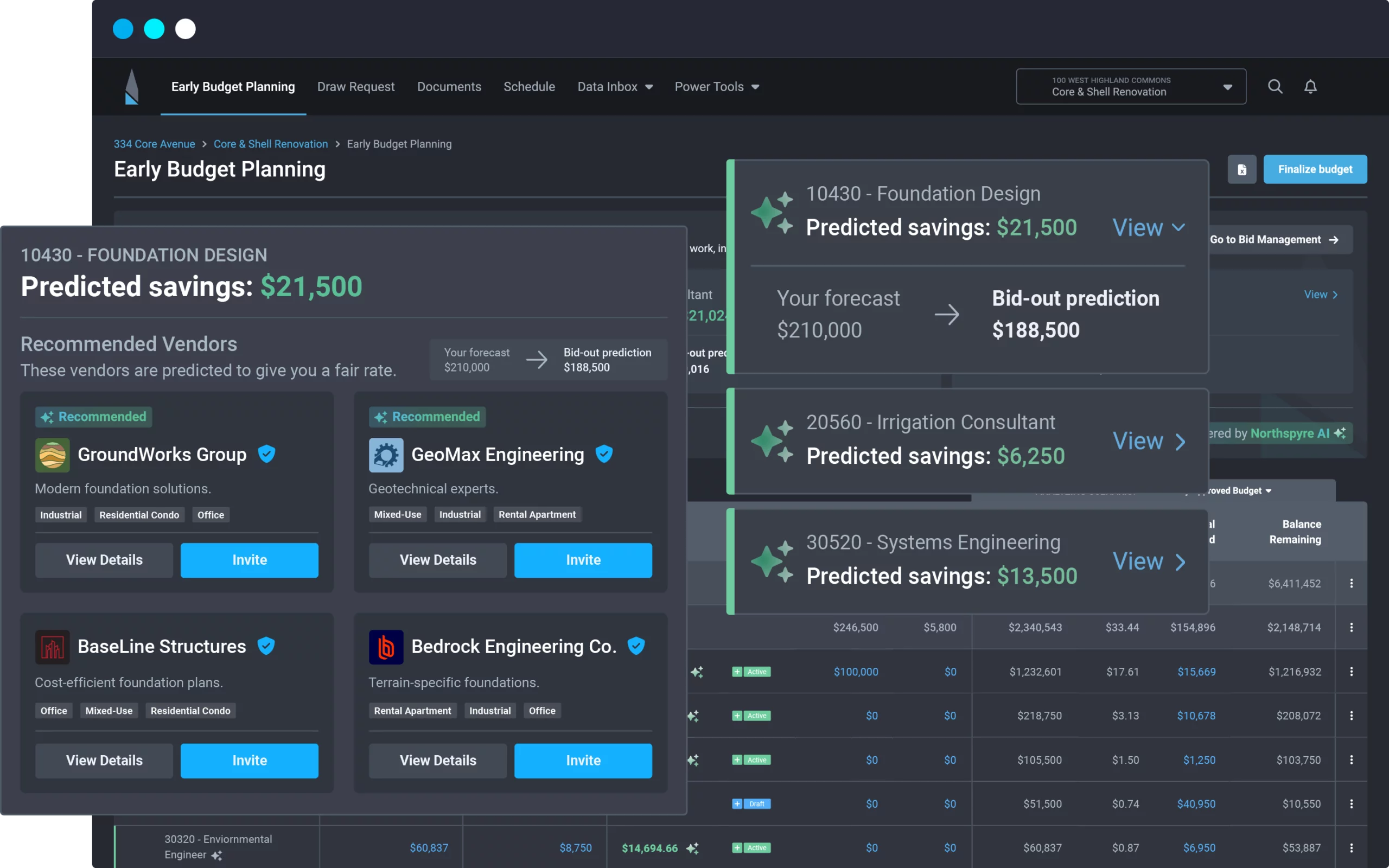

Inform stronger strategies

Make smarter assumptions and procurement decisions during early planning, lowering the risk of future exposures and change orders.

Optimize performance across your portfolio

Explore project performance in real-time to identify budget lines or vendors in need of attention and surface rich contextual insights to take informed action.

Scale best practices

Build enduring institutional knowledge and put best practices on repeat so you grow faster and never make the same mistake twice.

resources

Learn More About Northspyre

Explore Platform Features

Northspyre Platform Overview

Achieve predictable outcomes across your portfolio with one, integrated platform.

Explore Complex Capital Management

Complex Capital management

Managing multiple funding sources with varying requirements demands precision and control.

Industry Resources & Insights

Resource Center

In-depth eBooks, guides, and webinars for real estate developers.

See Northspyre in action

Get a demo to see how leading developers use Northspyre to work smarter at every stage of the development lifecycle.