Download the Guide

Complete this form to access the guide

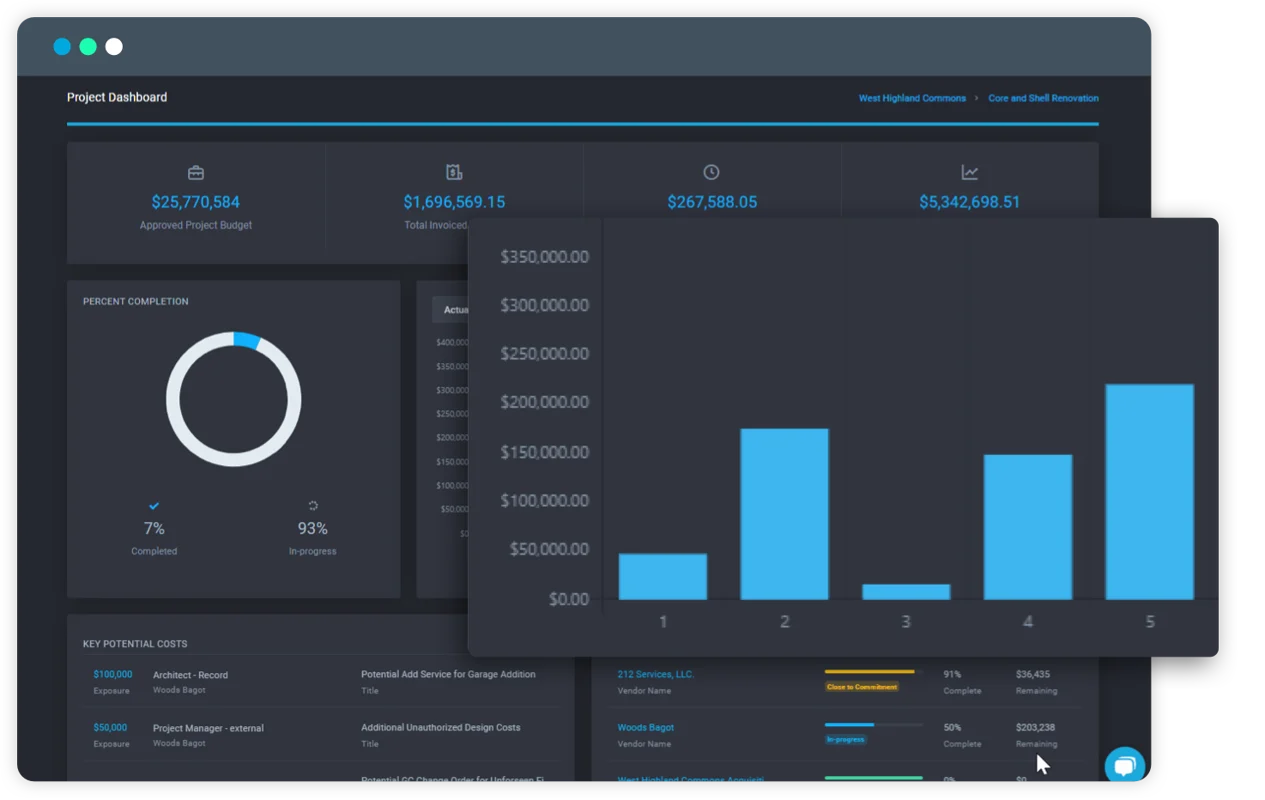

Real-Time Cost Data

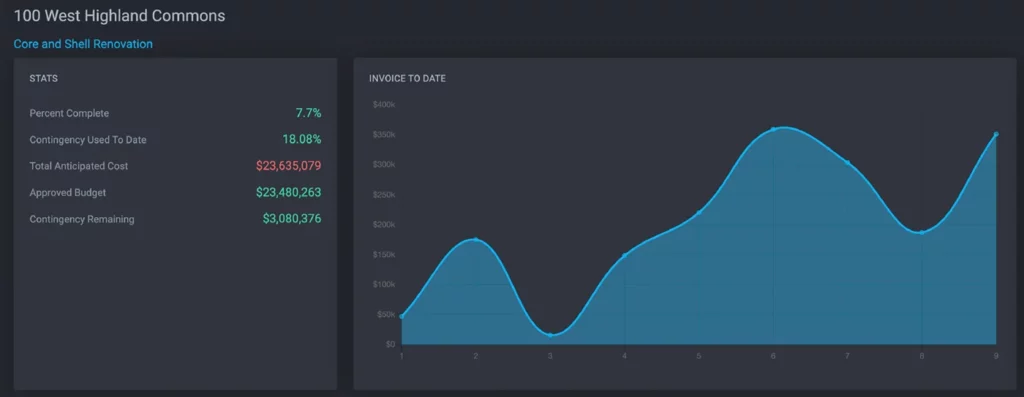

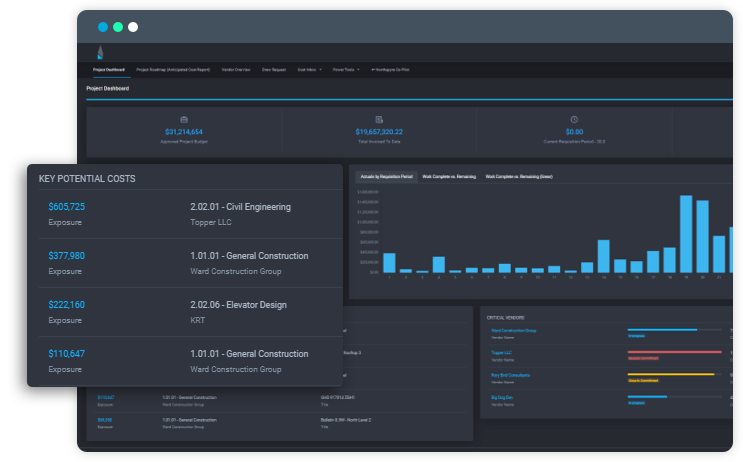

Project management in the construction phase is complex. Yet, it’s important to have a pulse on costs at any given time. This includes both the hard cost data and soft cost data. Effective utilization of this data ensures a more favorable outcome.

Hard Costs

costs that are directly related to the construction of your project. You may hear these referred to as “brick-and-mortar costs,” because they include the structure, construction site, and landscape.

Soft Costs

costs that are indirectly related to materials, labor, or the physical building of the project. They are considered “soft” because they are intangible.

As your project progresses, both types of construction costs become more of a factor. What you’re looking for is data that provides an accounting team with a clear vision of the financial implications.

Resources, logistics, and productivity are major aspects of this type of data. Having insights into resources enables your real estate development team to know what materials, equipment, and labor are necessary to complete a job. Having this data readily available in real-time, like a budget line trending high, helps project managers make adjustments quickly

This process usually involves multiple departments, including accounting, and inevitably leads to delayed information, difficulty tracking, and vendors being both over and underpaid. You’re making your job much harder for yourself if this is still how you’re working.

Modern tools allow you to track and organize vendor communications to help with visibility surrounding contractor management data. By embracing today’s most-helpful technology, successful real estate teams are able to dramatically increase visibility into a project or portfolio. They have fast, real-time access to all project data in order to always understand the status of a project and make critical, informed decisions.

As well, this also gives development teams the ability to quickly share project details in real-time with management teams, partners, clients, investors, and other key stakeholders. Accounting teams don’t want to also act as project managers. Ensuring data is easily flowing between teams helps accountants focus on their core job duties.

Industry Best Practices With Data

t’s easy to compromise on industry best practices as your project progresses. Maybe there’s a small compromise here and there in order to move the project forward faster, or because the best practice doesn’t feel needed at the time. But those little compromises add up to larger issues down the road. If you want to ensure the project remains on track it’s

important to follow industry best practices every step of the way, no matter how inconvenient it may seem.

Compiling and storing best practices, and baking them into your current workflows is the best way to ensure every action your team takes is up to industry standards. In turn, you’ll be well positioned to complete projects on time and under budget.

Examples of how to store and track your project against industry best practices include:

- Reporting templates that share pertinent data with stakeholders

- Cost-cutting development strategies that your project is actively checked against

- Checks to ensure decisions are data-backed vs. gut-driven

Return on Investment

Now that you’re well into the construction phase, it’s time to think about your return on investment (ROI). ROI is a widely used financial metric for measuring the probability of gaining additional funds from the initial investment made. It is a ratio that compares the gain or loss from an investment relative to its cost.

Your investors made an investment in your construction project and they want to know how well their investment has performed. By keeping all of your cost data readily available, you can produce ROI numbers quickly and make adjustments as needed.

The Importance of Commercial Real Estate Data for Your Team

The importance of commercial real estate data cannot be overstated. Having a single source of data is important to a project’s success, from the earliest stages of securing financing to finishing construction and handing it off to a property management team.

Tracking your team’s financial and performance data takes more than the commitment to do so. In fact, the process often goes off the rails when a team attempts to track too many different indicators using manual processes, spreadsheets, and force-fitted technology. This is because you’ll end up with more data than you can successfully analyze when the data is spread between multiple spreadsheets, stored away with different employees that have keystroke errors, resulting in decisions made based on a lack of or misguided information.

Clearly, these metrics are much easier to calculate if your team has the right software in place. Northspyre is real estate development software that was specifically designed to help track, analyze and make actionable decisions based on commercial real estate data from pre-development all the way through project completion.

Running a multi-million dollar real estate project in static spreadsheets often exposes your project to unnecessary risk, delays, and budget overruns. Knowing that, why would a savvy real estate developer manage a large project in a tool that is inflexible and error-prone?

Download the Guide

Complete this form to access the guide

See Northspyre in action

See how leading developers use Northspyre to work smarter at every stage of the development lifecycle.